Category: Attention

Finance of America to Acquire PHH Mortgage’s Reverse Servicing Assets, Opening Door to New Distribution Channel

In a move poised to reshape the reverse mortgage landscape heading into 2026, Finance of America Reverse (FAR) announced that it has reached an agreement[more...]

HUD Seeks Public Input on the Future of HECM and HMBS Programs

The U.S. Department of Housing and Urban Development (HUD) is asking industry stakeholders, consumer advocates, and the public to weigh in on the future of[more...]

Longbridge Financial Adopts One Diligence AI to Elevate Loan Servicing Accuracy and Efficiency

Longbridge Financial has integrated the AI-driven platform from One Diligence to modernize its loan servicing operations—achieving a 60% reduction in common data errors and meaningfully[more...]

Government Shutdown Freezes New HECM Endorsements, Payments Continue

The federal government shutdown has brought the endorsement of new Home Equity Conversion Mortgages (HECMs) to a standstill, though existing borrowers will continue receiving their[more...]

How Much Can a 70-Year-Old Borrow with a Reverse Mortgage Today?

Many retirees today find themselves in a unique financial position: rich in home equity, but limited in monthly income. With pensions fading and Social Security[more...]

David Peskin Acquires Ownership Stake in HighTechLending to Expand Reverse Mortgage Offerings

In a significant move within the reverse mortgage industry, David Peskin, a seasoned professional with a history at Senior Lending Network and Reverse Mortgage Funding[more...]

Ginnie Mae Advances Reverse Mortgage Initiatives with New MBS Exploration

Ginnie Mae is actively assessing the potential for a novel securitization product aimed at enhancing the scope of its Home Equity Conversion Mortgage (HECM) mortgage-backed[more...]

Exclusive Interview with an AI Startup Founder: Revolutionizing Reverse Mortgages with ReverseMortgage.AI

Exclusive Interview with an AI Startup Founder: Revolutionizing Reverse Mortgages with ReverseMortgage.AI In an exclusive interview with Reverse Mortgage News (RMN), we had the privilege[more...]

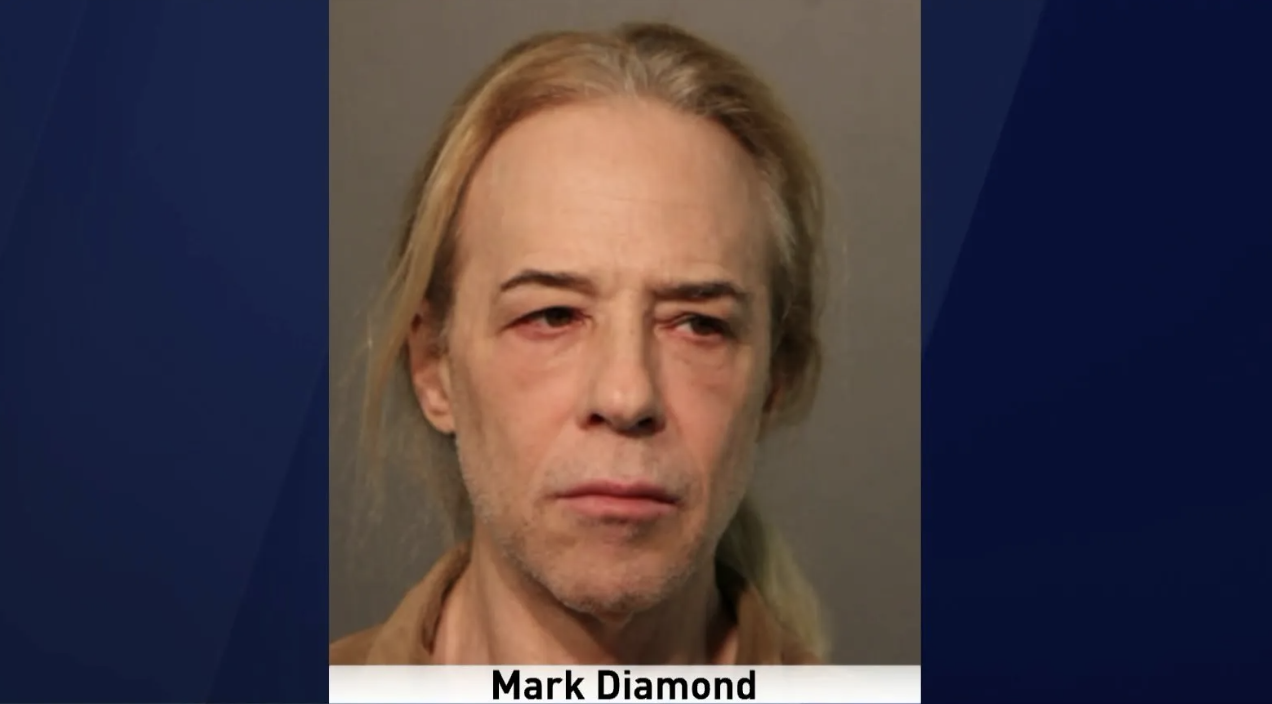

Reverse Mortgage Scam Artist Behind Bars Again After Defrauding Over 120 People

CHICAGO – Mark Diamond, a local businessman facing federal charges for allegedly orchestrating a fraudulent reverse mortgage scheme targeting elderly homeowners, has been ordered back[more...]

2023 Data Spotlight: Trends in Reverse Mortgage Direct Mail Advertising

In a recent report by the Consumer Financial Protection Bureau (CFPB) Office for Older Americans, trends in reverse mortgage direct mail advertising were scrutinized to[more...]